AGILITY. STABILITY. CONSISTENCY.

WEALTH ADVISORY SERVICES

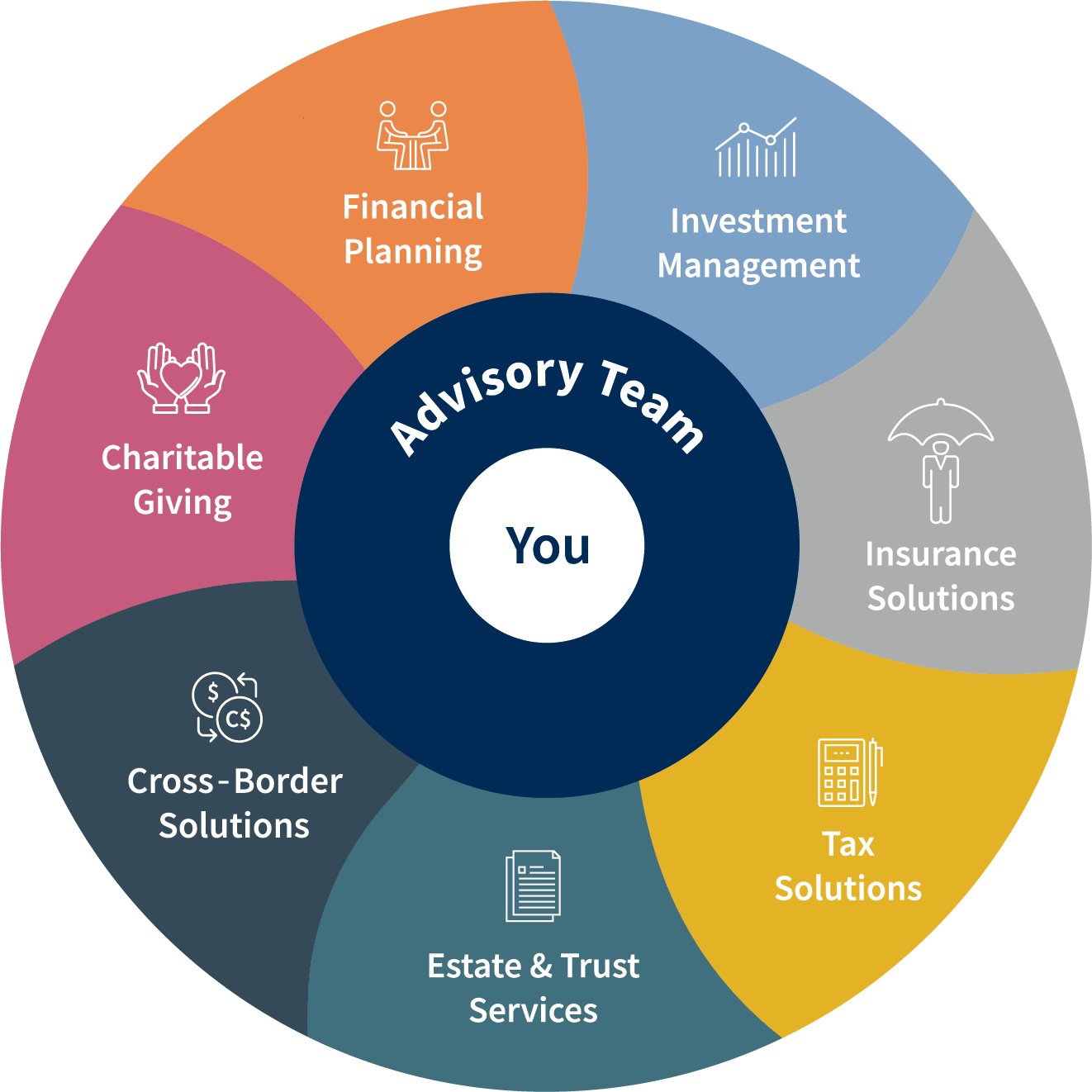

Our business is you and your financial well-being. We believe that professional advice, on-going education, and wealth planning are key to success. Our total wealth solutions approach looks at your entire life and all its moving pieces to incorporate financial planning, investment management, insurance solutions, tax solutions, estate and trust services, and charitable giving strategies based on your unique circumstances and wishes.

COMPREHENSIVE PLANNING

SV Wealth is a professional financial advisory group committed to providing clients with realistic wealth management strategies and efficient advice to realize their financial goals. We endeavour to fully understand and recognize the unique needs of each individual client and strive hard to build portfolios that emphasize quality and diversification.

Get to know Our Team

Information & insight